Are you looking for a way to enjoy Korean dramas without leaving your comfort zone? Look no further than Loklok, the premier app for both live and offline Kdrama streaming. Currently a hit among users, Loklok offers an easy and convenient way to watch all your favorite movies, TV shows, and more!

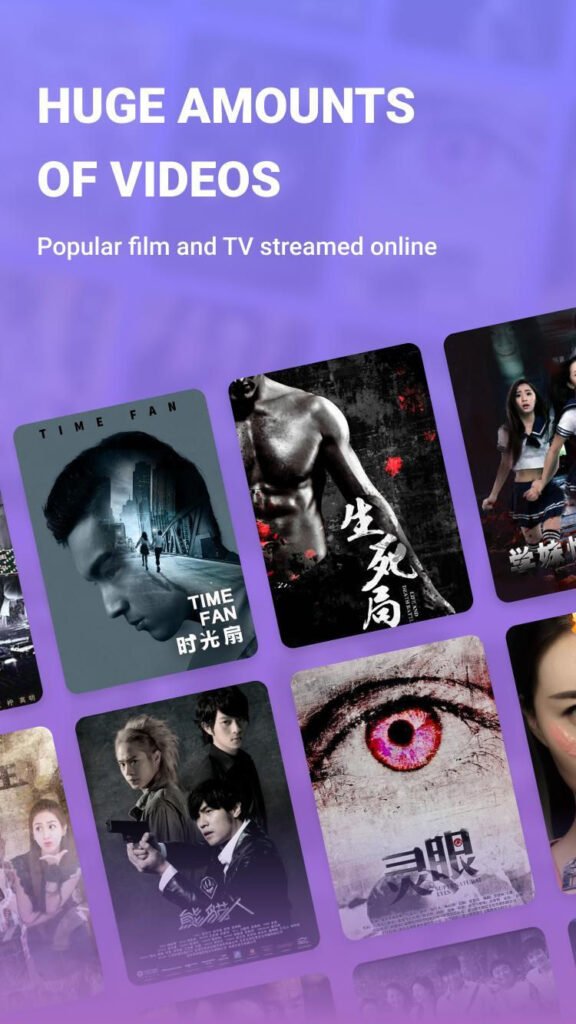

Diverse Content Library

Loklok has a wide variety of films and TV series from all over the world, including Hollywood, Bollywood, Korea, Japan, China, and many more. No matter what your mood is, you can find content for every taste, like horror, romance, comedy, thrilling mysteries, live TV, movies, and geographical shows.

User-Friendly Features

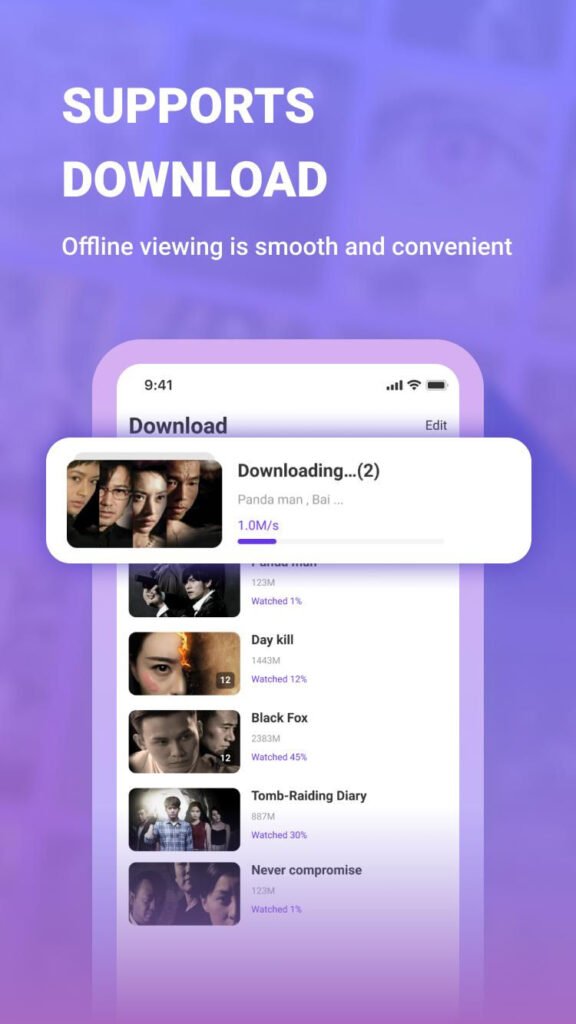

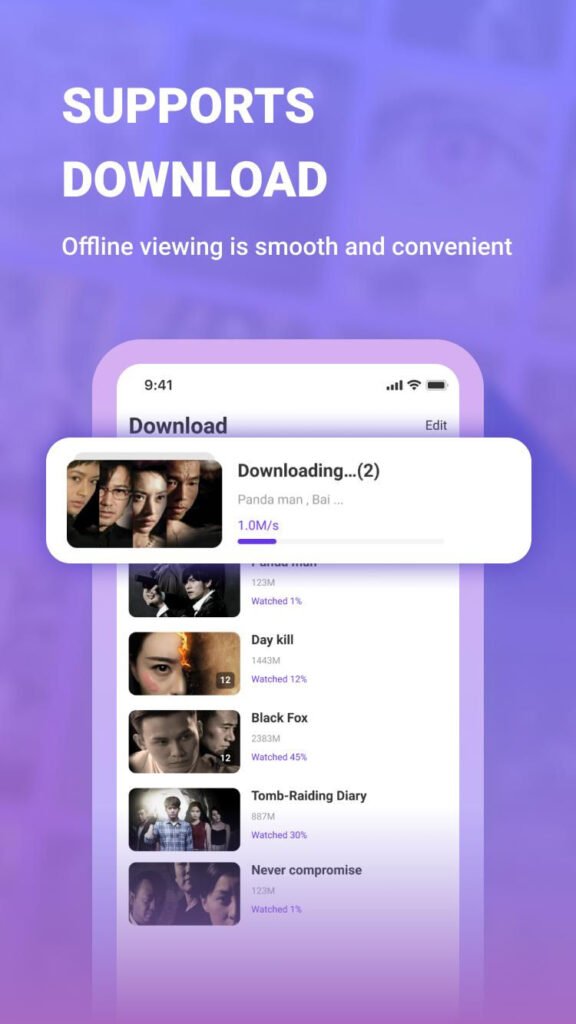

The app’s interface is simple and easy to use, making it perfect for beginners. All content is neatly organized, so you can easily find what you’re looking for. You can download videos over Wi-Fi and watch them later without using your data.

Download Offline

Loklok also lets you choose whether to save downloaded content to your internal storage or SD card. If you find something interesting, you can save it to watch later with ease.

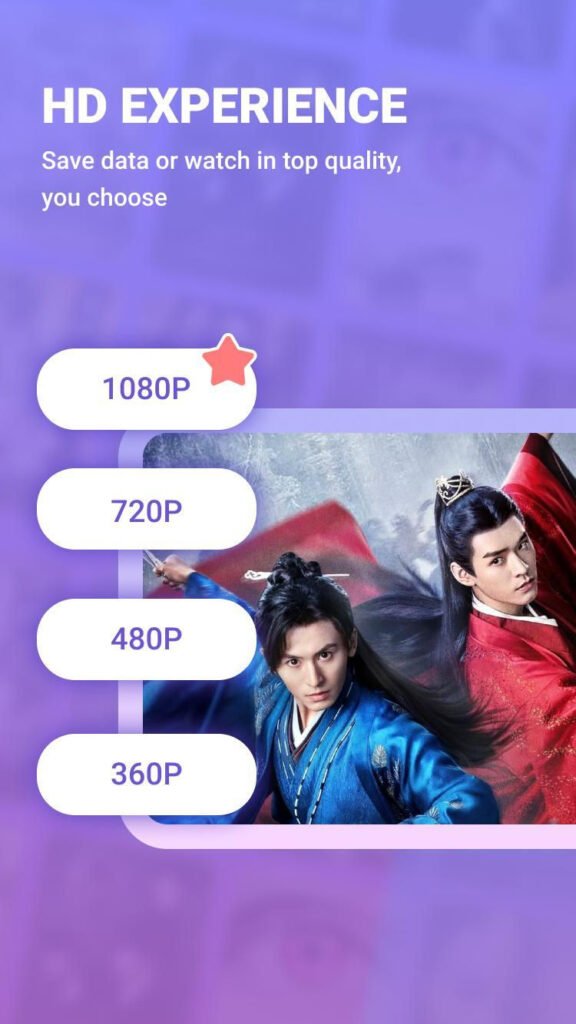

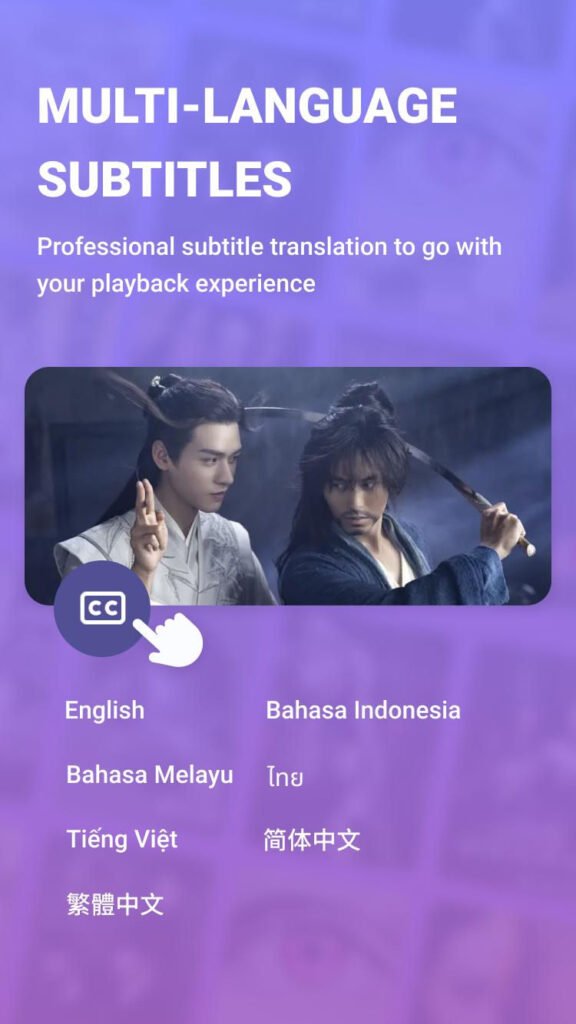

High-Quality Streaming

You can enjoy crystal-clear video in up to 1080p resolution. Loklok lets you choose from 144p to 1080p to match your internet speed. You can watch without any interruptions, from start to finish. Subtitles are available for free, making it easy to enjoy content from different cultures and languages.

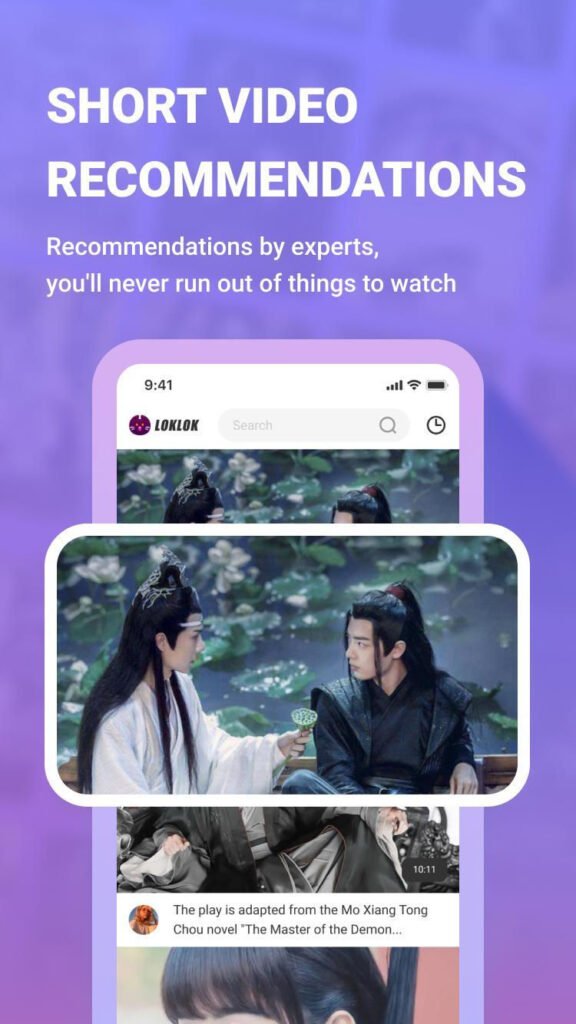

Personalized Recommendations

Loklok goes beyond just offering a massive library of content by providing personalized recommendations. Based on your viewing history and preferences, the app suggests movies, TV shows, and other content that you might like. This feature makes it easier for you to discover new favorites without having to search through thousands of titles.

Multi-Device Synchronization

With Loklok, you can start watching on one device and continue on another without any hassle. Your watch history and current playback are synced across all your devices, ensuring you can pick up exactly where you left off, whether you’re on your phone, tablet, or smart TV. This synchronization makes it convenient for users who like to switch between devices.

Notification Alerts for New Releases

Never miss out on the latest episodes of your favorite series or the release of new movies. Loklok keeps you updated with notification alerts whenever new content that matches your interests is added to the library. This feature ensures that you stay in the loop and catch all the newest releases as soon as they’re available.

| App Name | Loklok – Dramas & Movies |

| App Version | 2.12.1 |

| Size | 112 MB |

| Updated | 5 Hours ago |

| Required OS | Android 5.0 + |

| Rating | 4.7 |

| Package | com.tv.loklok |

Loklok FAQs

Here are the most frequently asked questions.

What is Loklok?

Loklok is a streaming app that allows you to watch a wide range of video content, including Korean dramas, movies, TV shows, and web series, for free.

Is Loklok free to use?

Yes, Loklok is completely free to use. There are no subscription fees or hidden charges.

Is Loklok app safe?

Yes, Loklok is completely safe to use. To ensure safety, always download apps from reliable and official sources and be cautious of the permissions you grant to the app.

Is Loklok app legal?

The legality of using Loklok depends on how it sources and provides content. Streaming copyrighted material without proper authorization is illegal in many countries.

Is Loklok app available on PC?

Loklok is primarily designed for Android devices. However, you can use Loklok on PC by installing an Android emulator which allows you to run Android apps on your computer.

Is Loklok app available on iOS?

As of the latest updates, Loklok is not available on iOS. It is mainly developed for Android users.